Navigate Your Online Tax Obligation Return in Australia: Vital Resources and Tips

Browsing the on-line tax return process in Australia requires a clear understanding of your commitments and the resources readily available to streamline the experience. Important records, such as your Tax Obligation Documents Number and revenue declarations, must be diligently prepared. Choosing an appropriate online platform can considerably impact the performance of your filing procedure. As you consider these factors, it is vital to likewise understand usual risks that many encounter. Recognizing these subtleties might eventually save you time and decrease stress-- bring about a more desirable result. What methods can best assist in this venture?

Recognizing Tax Obligation Responsibilities

Understanding tax obligations is important for organizations and individuals operating in Australia. The Australian taxation system is governed by numerous legislations and guidelines that need taxpayers to be familiar with their responsibilities. Individuals have to report their income precisely, which consists of salaries, rental revenue, and financial investment incomes, and pay taxes as necessary. Moreover, citizens need to comprehend the distinction between non-taxable and taxed income to make sure conformity and maximize tax end results.

For companies, tax obligations incorporate multiple elements, consisting of the Product and Provider Tax Obligation (GST), business tax, and pay-roll tax. It is important for companies to sign up for an Australian Company Number (ABN) and, if applicable, GST registration. These duties demand precise record-keeping and prompt submissions of income tax return.

In addition, taxpayers should recognize with available deductions and offsets that can alleviate their tax obligation concern. Inquiring from tax experts can offer valuable understandings into enhancing tax placements while making sure compliance with the regulation. Overall, a detailed understanding of tax obligation responsibilities is crucial for effective monetary planning and to stay clear of fines connected with non-compliance in Australia.

Vital Papers to Prepare

Furthermore, put together any type of relevant bank declarations that mirror passion income, along with reward declarations if you hold shares. If you have various other resources of income, such as rental residential or commercial properties or freelance work, ensure you have records of these profits and any kind of associated costs.

Consider any kind of personal wellness insurance coverage statements, as these can influence your tax responsibilities. By gathering these crucial papers in advance, you will improve your online tax return process, lessen mistakes, and optimize possible refunds.

Picking the Right Online Platform

As you prepare to file your on-line income tax return in Australia, choosing the ideal platform is necessary to make certain accuracy and convenience of usage. Several crucial elements must direct your decision-making process. Initially, consider the platform's interface. An uncomplicated, intuitive style can considerably enhance your experience, making it much easier to browse intricate tax kinds.

Next, examine the system's compatibility with your economic scenario. Some services cater especially to individuals with easy income tax return, while others supply detailed support for a lot more complicated situations, such as self-employment or financial investment revenue. Furthermore, search for platforms that use real-time mistake monitoring and advice, helping to minimize blunders and ensuring compliance with Australian tax obligation regulations.

Another important aspect to take into consideration is the degree see it here of client support available. Reputable systems must offer access to assistance via phone, conversation, or email, especially throughout optimal filing periods. Additionally, study individual evaluations and scores to determine the general fulfillment and dependability of the platform.

Tips for a Smooth Filing Process

Submitting your online tax obligation return can be an uncomplicated procedure if you follow a few vital tips to make sure performance and accuracy. This includes your income statements, invoices for deductions, and any type of various other pertinent documentation.

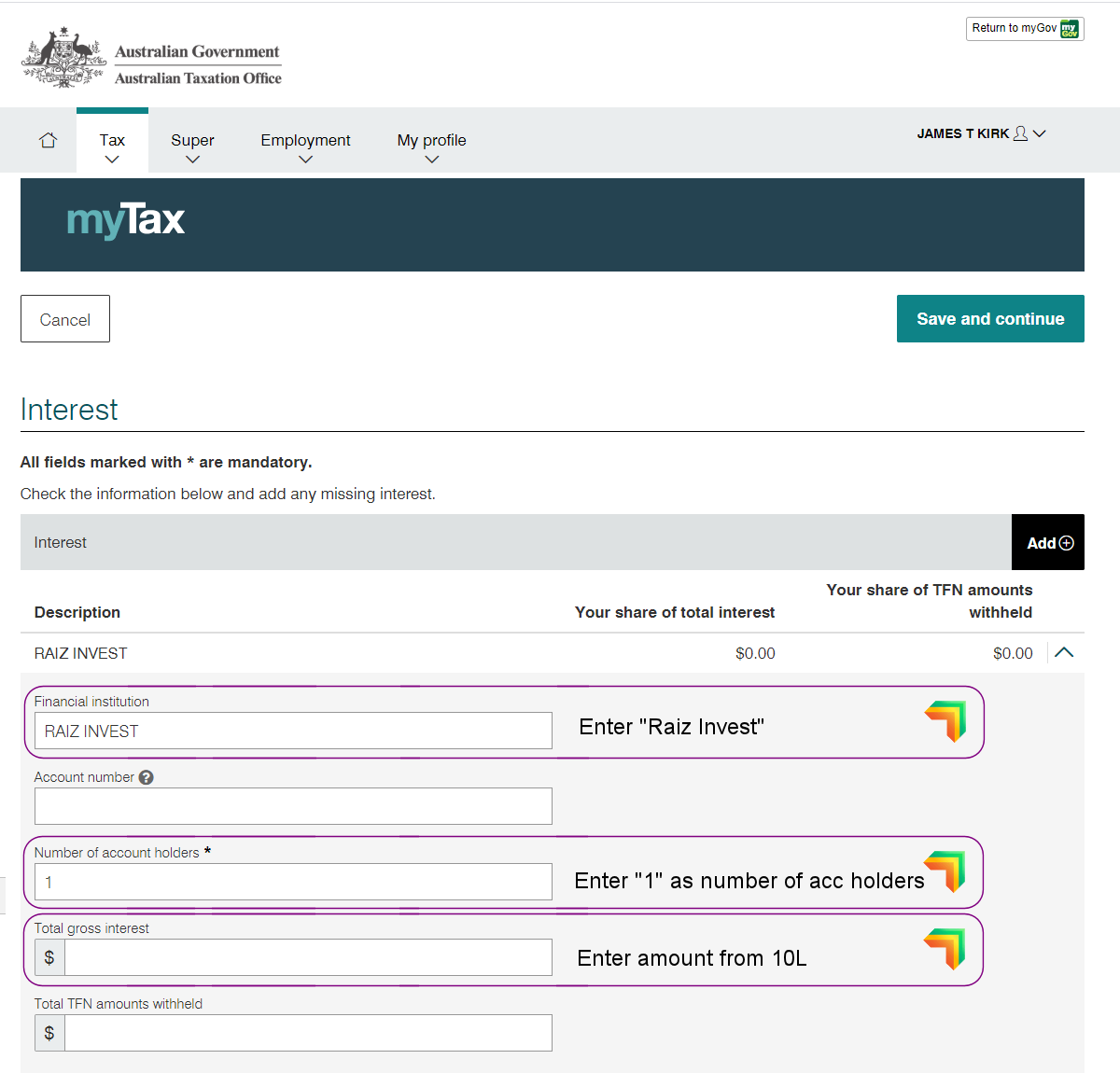

Next, benefit from the pre-filling attribute offered by numerous on the internet platforms. This can save time and minimize the opportunity of blunders by instantly populating your return with info from previous years and information given by your company and economic organizations.

In addition, confirm all access for precision. online tax return in Australia. Blunders can lead to delayed reimbursements or concerns with the Australian Taxes Workplace (ATO) Make certain that your personal details, earnings figures, and deductions are appropriate

Filing early not just decreases anxiety however likewise enables for much better planning if you owe tax obligations. By complying with these suggestions, you can browse the on the internet tax obligation return process efficiently and confidently.

Resources for Aid and Support

Browsing the complexities of on the internet tax obligation returns can often be overwhelming, however a selection of sources for assistance and support are readily available to aid taxpayers. The Australian Tax Workplace (ATO) is the primary resource of information, offering comprehensive overviews on its website, including Frequently asked questions, training videos, and live chat alternatives for real-time assistance.

Furthermore, the ATO's phone assistance line is available for those that favor direct interaction. online tax return in Australia. Tax obligation experts, such as licensed tax obligation agents, can likewise give tailored guidance and make sure compliance with current tax regulations

Verdict

Finally, properly navigating the online income tax return procedure in Australia calls for a complete understanding of tax obligation obligations, thorough preparation of essential documents, and careful selection of an ideal online system. Abiding by functional pointers can boost the declaring experience, while available resources offer beneficial aid. By approaching the process with diligence and focus to information, taxpayers can make certain conformity and make best use of potential benefits, inevitably adding to a much more successful and efficient tax obligation return result.

As you prepare to file your online tax obligation return in Australia, selecting the appropriate platform is crucial to ensure precision and simplicity of usage.In final thought, effectively navigating the on the internet tax return process in Australia calls for a detailed understanding of tax commitments, precise prep work of vital documents, and cautious option of an ideal online system.

Comments on “How to Maximize Your Refund with an Online Tax Return in Australia This Year”